Argentina: Chinese Development Finance Profile, 2000-2022

Date Published

Oct 10, 2025

Authors

JulieAnn Sickell, Rory Fedorochko, Brooke Escobar

Publisher

Citation

Sickell, J., Fedorochko, R, and Escobar, B. (2025). Argentina: The Scale, Scope, and Composition of Chinese Development Finance. Williamsburg, VA: AidData at William & Mary.

Abstract

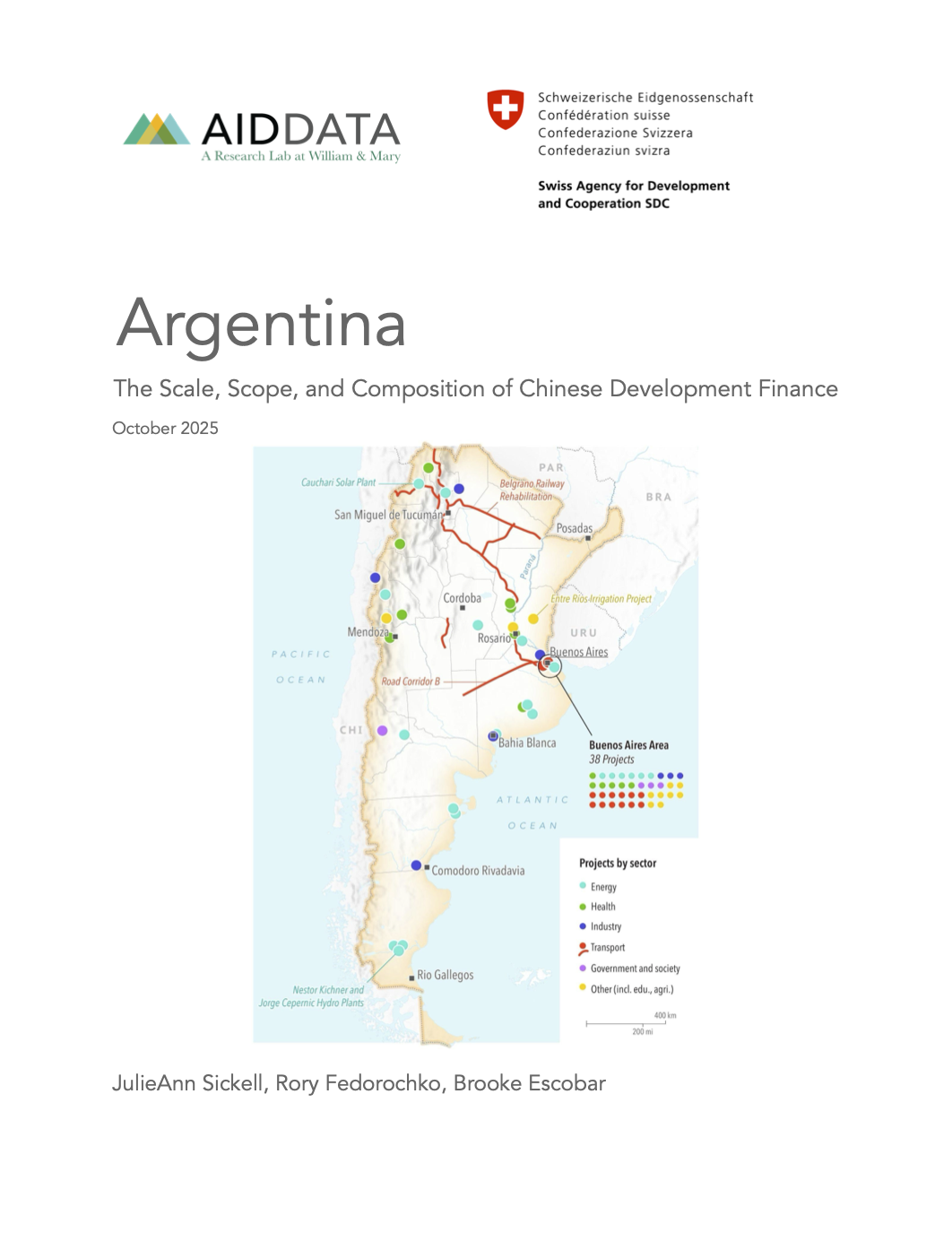

This country profile provides a detailed overview of the scale, scope, and composition of Chinese state-directed financing in Argentina from 2000 to 2022. It includes granular information on key trends in China’s loan and grant-financed commitments, its lending portfolio, ESG risks in its infrastructure projects, and contractual safeguards adoption and implementation.

From 2000 to 2022, China directed $38.6 billion in loan and grant-financed commitments for 202 projects in Argentina. Beijing bankrolls Buenos Aires through a mix of large-scale credit lines, central bank currency swaps, and project finance, giving Argentina a vital buffer during recurring balance of payments crises. Argentina has drawn down up to $22 billion annually under its swap line with the People’s Bank of China (PBOC) since 2014.

The insights in this profile are derived from AidData’s Global Chinese Development Finance Dataset, Version 3.0 and the sources referenced therein. Additional 2022 data collection is based on a forthcoming dataset version launching in November 2025.