Las Bambas Copper Mine: Chinese Financing for Transition Minerals

Date Published

Jan 30, 2026

Authors

Lydia Vlasto and Katherine Walsh

Publisher

Citation

Vlasto, L. and Katherine Walsh. (2026). Las Bambas Copper Mine: Chinese Financing for Transition Minerals. Williamsburg, VA: AidData at William & Mary.

Abstract

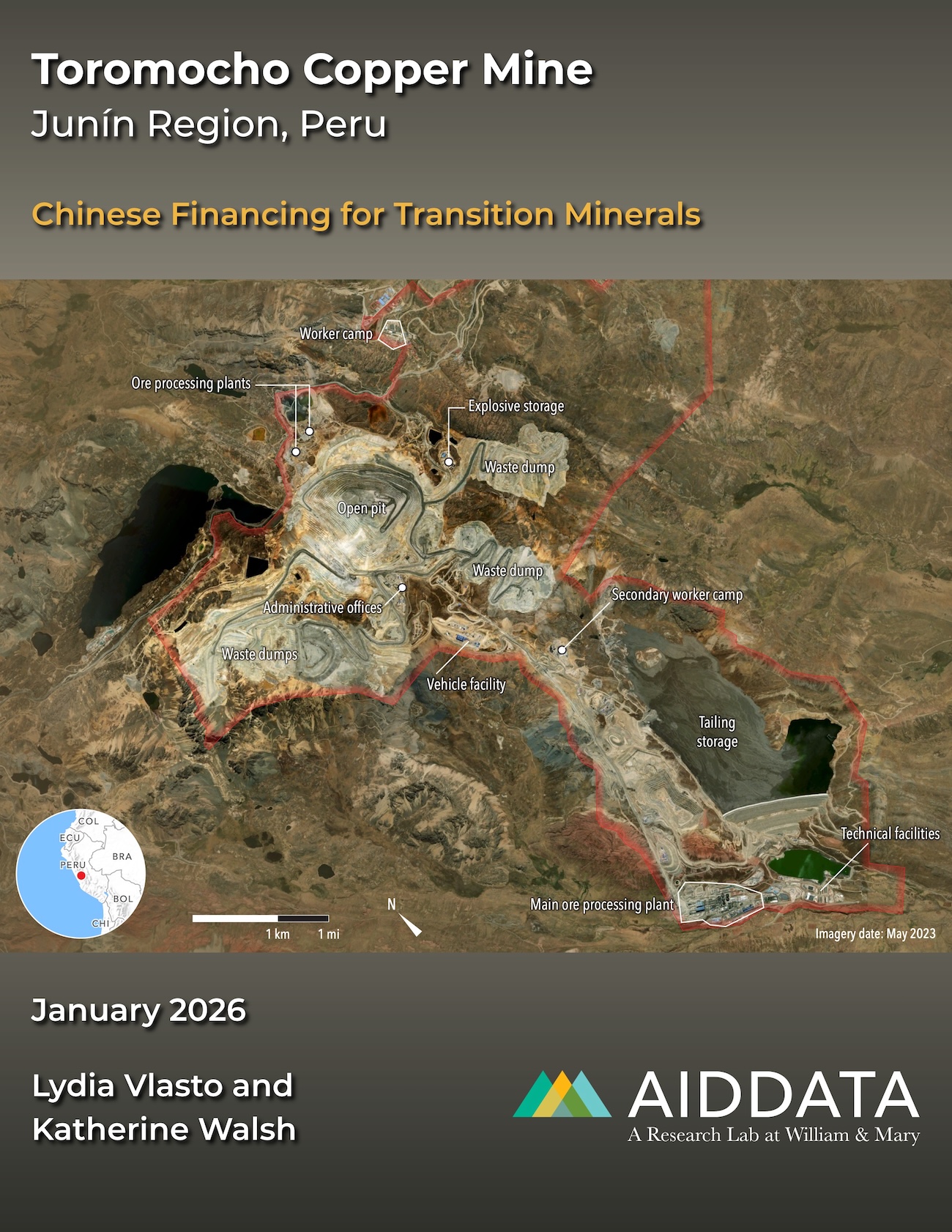

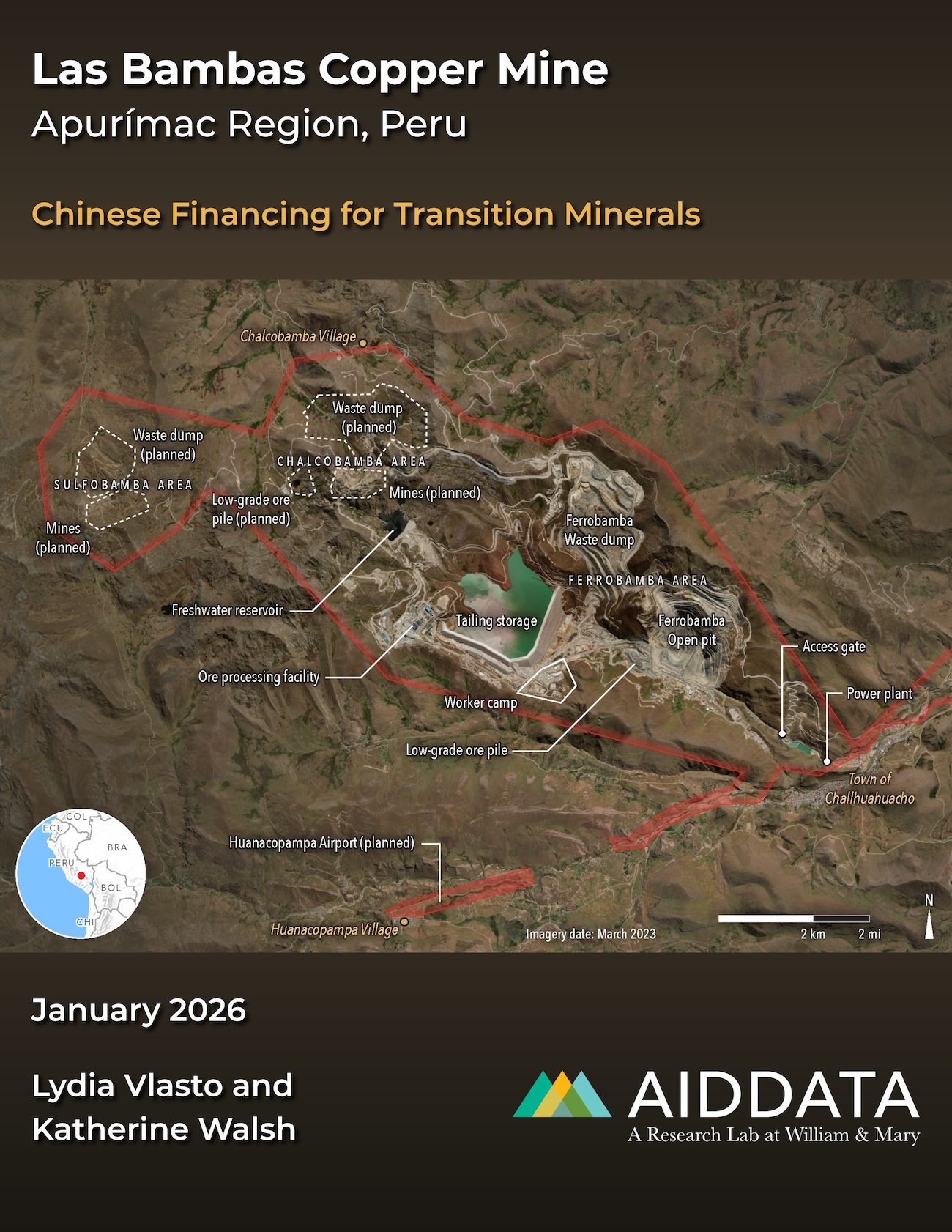

Located across three districts within Peru’s Apurímac region, Las Bambas is one of the world’s largest copper mines. Enabled by a $6.96 billion acquisition financed by a consortium of Chinese banks, the mine has been in commercial operation by a group of Chinese companies since 2016. It has since faced significant environmental and social challenges, leading to frequent protests by local communities that have disrupted operations.

This mining site profile provides a detailed overview of Chinese state-directed financing, ownership, and operations of Las Bambas. It includes granular information on the mine's funding sources (loans, lenders, and co-financing), acquisition history, ownership structure, implementation milestones, ESG challenges, and risk mitigation measures.

The insights in this profile are derived from AidData’s Chinese Financing for Transition Minerals Dataset, Version 2.0 and the sources referenced therein. This dataset captures over $98 billion of official sector financial commitments that China provided to 47 low-, middle- and high-income countries between 2000 and 2023 for projects involving the extraction or processing of critical minerals. An accompanying report, Power Playbook: Beijing’s Bid to Secure Overseas Transition Minerals, analyzes the 1.0 version of this dataset and provides evidence about the nature, scale, and scope of the PRC’s overseas financing for the extraction and processing of energy transition minerals.

Note: This profile was first published in February 2025 and updated in January 2026.